Oversea-Chinese Banking Corp (OCBC) is partnering with Singaporean personal finance portal MoneySmart.sg to offer a lower rate mortgage package.

The deal, a limited offer running for only 15 days starting today, consists in a fixed deposit-linked interest rate plan at 36-month fixed deposit mortgage rate of 1.63% (OCBC 36FDMR: 0.65%, plus 0.98%) for the first three years on a loan of S$500,000 and above.

In comparison, Singapore’s DBS Bank currently offers a fixed deposit home rate of 1.95% for a two-year lock-in period, based on its prevailing 18-month fixed deposit rate for amounts from S$1,000 to S$9,999.

The OCBC Bank’s package, available through the MoneySmart.sg portal, is open to homeowners and buyers looking to refinance or apply loans for their completed or resale private properties.

“OCBC Bank partnering with an independent high-value personal finance comparison portal is an opportune alliance and we see significant value in this synergy,” OCBC Bank’s head of home loans Lee Mei Ling said.

“Through this partnership, we are happy to offer MoneySmart.sg’s extensive consumer base the opportunity to take up our most popular pricing option.”

Founded in 2009, MoneySmart.sg is a personal finance portal that aims to help Singaporeans maximize their money by curating and aggregating product information of a number of personal financial products. The platform is reportedly drawing some 1.5 million page views per month with 500,000 unique visitors.

New fintech unit

The partnership between OCBC and MoneySmart.sg becomes just a week after the bank announced the launch of its new fintech and innovation lab.

Called ‘The Open Vault at OCBC,’ the lab aims to drive open innovation and help the bank develop relevant ideas to enhance processes in banking and insurance. It should also help OCBC Bank tie strategic partnerships with local startups.

“Our key focus is to deliver tangible outcomes and value; without this, we would not want to play in the Fintech arena … We know the world of Fintech is wide and deep,” Samuel Tsien, OCBC Bank’s Group Chief Executive Officer, said in a statement.

“More good ideas can be developed by working with external partners such as Fintech accelerators, technology scouts, universities and other key stakeholders in the Fintech ecosystem.”

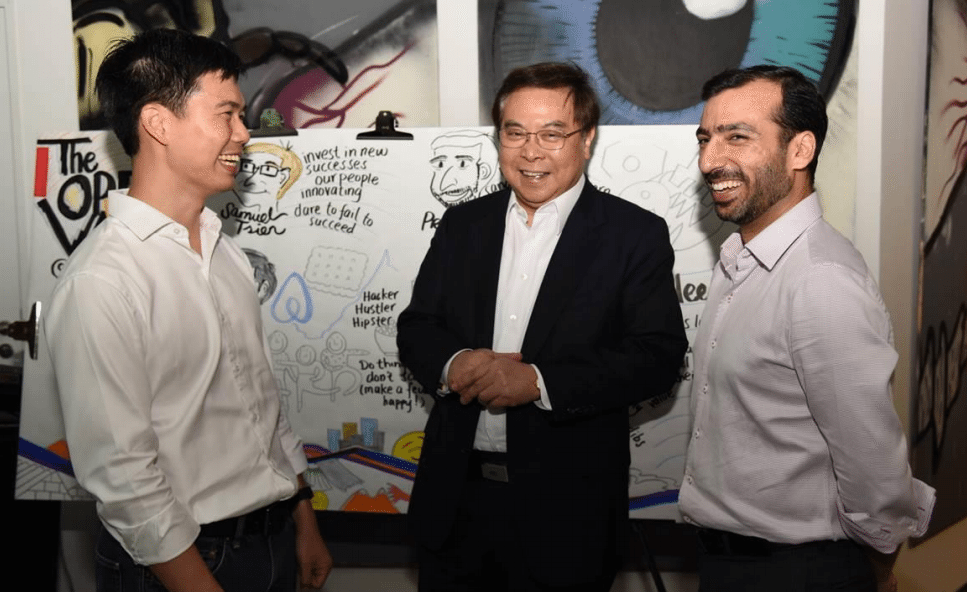

OCBC Bank’s Group Chief Executive Officer, Samuel Tsien (center), chats with Jia Jih Chai (left), Airbnb’s Managing Director for South East Asia, and Pranav Seth (right), OCBC Bank’s Head of E-Business and Business Transformation, during a networking event at The Open Vault at OCBC – Image via OCBC Bank

The Open Vault at OCBC is housed in a 2,400 square foot space on New Bridge Road, Singapore, and is open to fintech startups to work with in-house OCBC Bank experts to employ the bank’s data sandbox and APIs.

The Open Vault at OCBC, led by Pranav Seth, OCBC Bank’s Head of E-Business and Business Transformation, focuses on five key areas of innovation:

Wealth management: using data to improve the day-to-day money and cash flow management of customers by monitoring customers’ expenses and bill payments, and offering non-traditional banking solutions such as recommendations of grocery item offers to help them manage their expenses.

Credit and financing: exploring alternative credit assessment approaches to extend financing to new retail and corporate customer segments.

Insurance: using data to monitor customers’ risk profiles and lifestyles and provide consumers with innovative health and insurance solutions such as preventive care mobile aplications.

Cyber security: exploring new technologies in banking security to provide customers with a convenient and secure way to pay using their mobile devices.

Artificial intelligence: enhancing knowledge of customers through data analysis and bank-end banking services to provide advanced robot advisory.

Last but not least, OCBC Bank will kick off its accelerator program in April 2016. Innovators and Fintech start-ups can apply for OCBC Bank’s accelerator program at www.theopenvaultatocbc.com. Applications will close on March 17, 2016.

Featured image: OCBC Bank, Wikimedia.

The post OCBC Bank Teams up with MoneySmart.sg to Offer Lower Mortgage Rate appeared first on Fintech Singapore.